BacTech Environmental Corp. (BAC:CSE;BCCEF:OTCQB;OBT1:FRA) came out with the big news on Friday after the market closed.

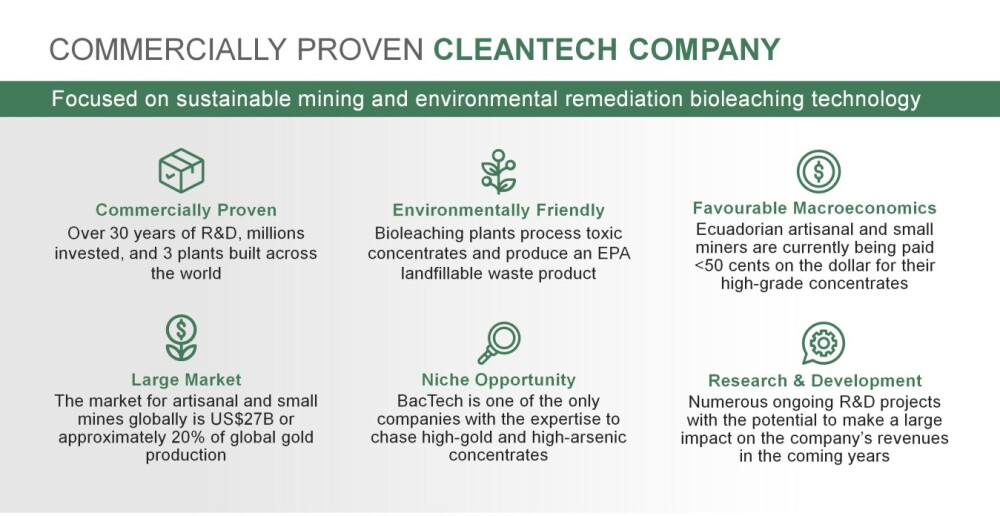

The news was that it has filed an expanded provisional patent application for its application of the bioleaching process for millions of tons of tailings to create zero waste using green technology and power.

The company's newest intellectual property (IP) retains the bioleaching approach to recovering metal values and producing multiple commodities from low-grade mine wastes but now introduces novel innovations to selectively convert soluble iron into iron metal for green steel making and produce ammonium sulfate fertilizer from the sulfur which is converted to acid during bioleaching.

We were a little early recommending the stock on February 11 at $0.06 as it went on to drop a little more before stabilizing at a slightly lower level ahead of Friday's break higher, but it is often better in this game to be early than late, especially as, in this case, the release of the news after the market closed means that investors will only be able to start reacting to it on Monday, and it is reasonable to presume, given how positive this news is, that the stock will advance further once trading resumes this week.

On the latest 6-month log chart, we can see that the price already broke out of the downtrend on Friday on good volume, a development that marks the start of a new uptrend, and we can also see that the improving Accumulation line and momentum (MACD) telegraphed this development ahead of time. Given how significant this news is, it is thought likely that the stock will initially run at least to the resistance level in the 9 to 10 cent area, and with respect to the longer-term outlook, you are referred back to the longer-term charts shown in the original February article.

It is hard to overstate the significance of the technology BacTech has developed for the mining industry and the environment worldwide. There are hundreds of millions or even thousands of millions of tons of these tailings lying around all over the world, which are a nuisance and a pollutant — just as an example, there are estimated to be 80 – 100 million tons of them in Sudbury basin Ontario alone.

BacTech's technology has the capacity to convert all of this waste into profitable assets and clean up the mess at the same time. This is why, given that BacTech has patented its processes and technology, its stock has such huge potential upside.

We, therefore, stay long, and BacTech Environmental stock is rated as a Strong Buy for all timeframes.

BacTech Environmental's website.

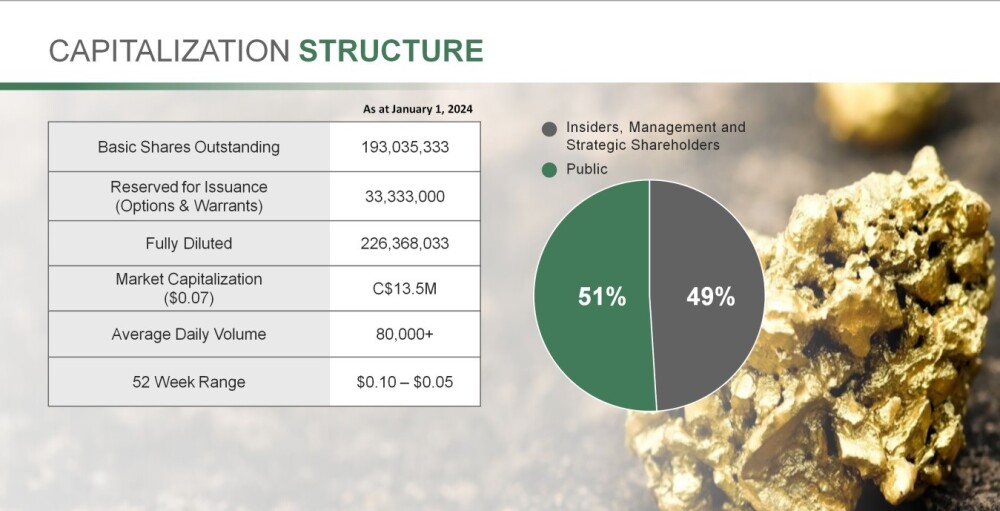

BacTech Environmental Corp. (BAC:CSE;BCCEF:OTCQB;OBT1:FRA) closed at CA$0.07, $0.053 on April 5, 2024.

Want to be the first to know about interesting Gold, Base Metals, Silver and Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- BacTech Environmental Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, BacTech Environmental Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BacTech Environmental Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.